Doing Business Here

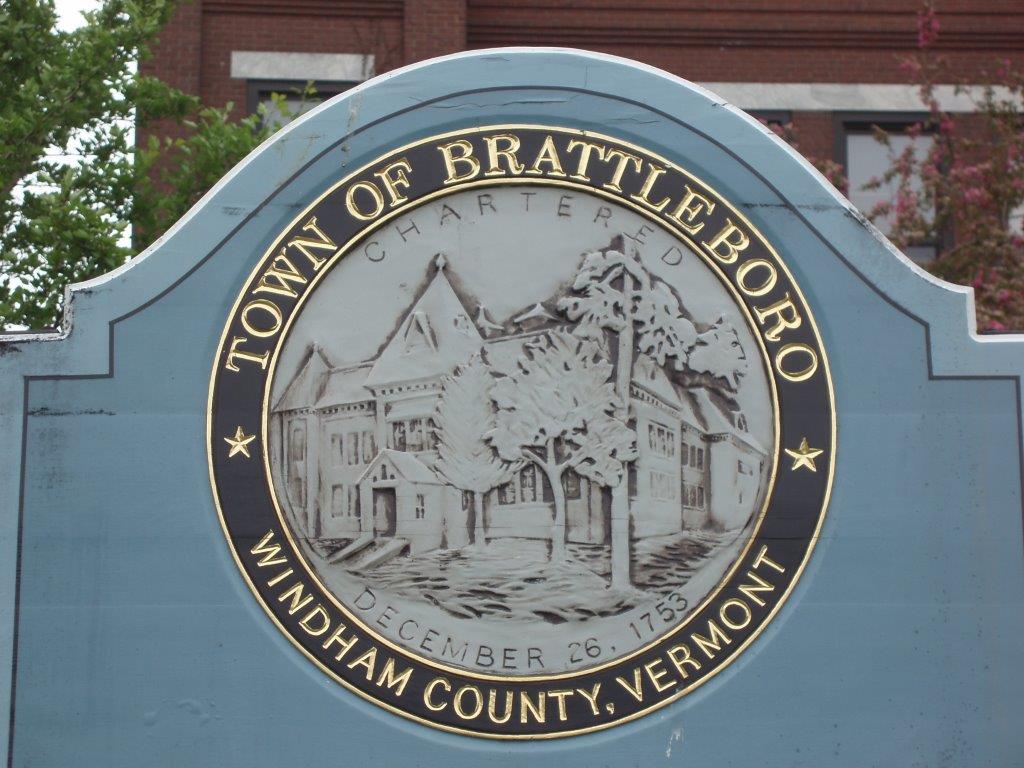

Brattleboro, Vermont:

A Great Place to Do Business!

Windham County and the greater Brattleboro area is a great place to do business. We have a diverse business community – manufacturing, health care, food producers, art, retail and tourism to name just a few – and a quality of life that can’t be beat!

Our Business Community

Here, you’ll find businesses that sell their products nationally while operating with a commitment to socially responsible and sustainable business practices; businesses recognized for innovation, design, and ingenuity; and businesses committed to improving life right here in Windham County. Get to know the businesses that operate and thrive in our region.

Starting & Operating a Business

Thinking of starting your own business? You’re in good company! Our community is filled with entrepreneurs in every industry.

As you get organized, one of the first steps you need to take it registering your business with the State of Vermont. A business license is required for all businesses located in Brattleboro. It may also be necessary to have other permits or licenses depending on the work you are doing.

Vermont’s state website offers great information walking you through the steps required to get your business off the ground.

Unique, Centralized Location

Conveniently located at the cross-section of three states, Windham County places all of New England and several major East Coast markets within easy access by car, bus, or train.

Surrounded by the Green Mountain and the Connecticut River, southern Vermont offers the peace and scenery of rural life without sacrificing convenience.

Business Support Services

Brattleboro, Windham County, and the State of Vermont have diverse support services for your business. Explore the organizations, which offer resources to help your business thrive.

Southeastern Vermont Community Action (SEVCA)

SEVCA’s Micro Business program supports would-be and growing businesses with business plan development, budgeting, and business counseling services. They also provide services, which address community needs and support individuals & families.

Downtown Brattleboro Alliance (DBA)

The DBA is the official non-profit Designated Downtown Organization for the Town of Brattleboro, providing access to grants, technical assistance and networking opportunities. The DBA is led by a volunteer Board of Directors which includes local business owners, property owners, educators, and town representatives.

Brattleboro Development Credit Corporation (BDCC)

A private non-profit economic development organization that serves as a catalyst for economic growth in Windham County. BDCC’s services include: business assistance, mentoring, conduit for available financing and incentives; and support for training assistance.

Southern Vermont Young Professionals (SoVTYP)

The Southern Vermont Young Professionals is the premier social and professional networking organization for people ages 22-25 who live and work in Windham County.

Vermont Department of Economic Development

The Vermont Department of Economic Development is a valuable resource for new businesses coming into the area. Their mission statement, to “Enhance Vermonters’ quality of life through expanded economic opportunity” defines their commitment to the business community of the Green Mountain State.

The Brattleboro Area Chamber of Commerce is the leading business and community organization in Windham County. We strive to enhance a thriving business community by providing business leadership, advocacy, and value to our members. The Chamber’s goal is to support the community and promote the region as the ideal place to live, work, visit, and do business.

We’ve supported countless businesses across industries to flourish in our community and are here to support with anything you need.